Car Loans Australia

Put your dream in your driveway with Responsive Lending.

Getting a quote from us is cost and obligation free.

Loans from $5,000 to $200,000

Rates from 6.19%* APR

Loan terms typically 3–7 years (varies by lender)

Fees - fees vary by lender; disclosed up-front before you proceed.

Extra repayments - available with many lenders, and most lenders offer no early exit fees (we’ll match you to the right product)

Settlement time - funds can settle as quickly as 24–48 hours after approval

* Subject to suitability, affordability and verification

Easy Car Loans

Loans from $5,000 to $200,000

Rates from 6.19%* APR

Getting a quote from us is cost and obligation free.

* Subject to verification, affordability & suitability

Wide Range of Car Loan Options

Bad Credit Car Loans

You could get a second chance on a new or used car with a Bad Credit Car Loan*.

Pensioner Car Loans

Pensioner Car Loans up to $12,000 for applicants on eligible pension payments*.

Low Rate Car Loans

Be rewarded for your excellent credit history with Low Rate Car Loans from 6.19%*.

* Subject to verification, affordability & suitability

Car Loan Repayment Calculator

Car Loan Repayment Calculator

Get an estimate on your loan repayments with our car loan calculator.

Estimate repayments in seconds, then get your personalised rate without affecting your credit score.

Need help finding a car?

Work utes, SUVs, wagons, hatchbacks, new and used. We partner with dealers all across Australia to help you find what you're looking for.

Why a Responsive Lending car loan?

Great Low Rates

Our rates start from 6.19% and with our large lending panel, we're able to find the best loan rate for you!

Fast Approvals

Our brokers work tirelessly to get your loan settled as quickly as possible. Many customers receive same-day conditional approvals, and funds can settle within 24–48 hours once all documents are verified (timeframes vary by lender and scenario).

40+ Lenders

We have over 40 lenders on our panel who we work with to match you with a lender that will get you the best loan interest rate for your circumstances.

Expert Guidance & Support

Our expert team ensures a smooth process, evaluating your needs and guiding you to the best plan hassle-free.

Refinance your existing car loan with Responsive Lending

See What Our Customers Think

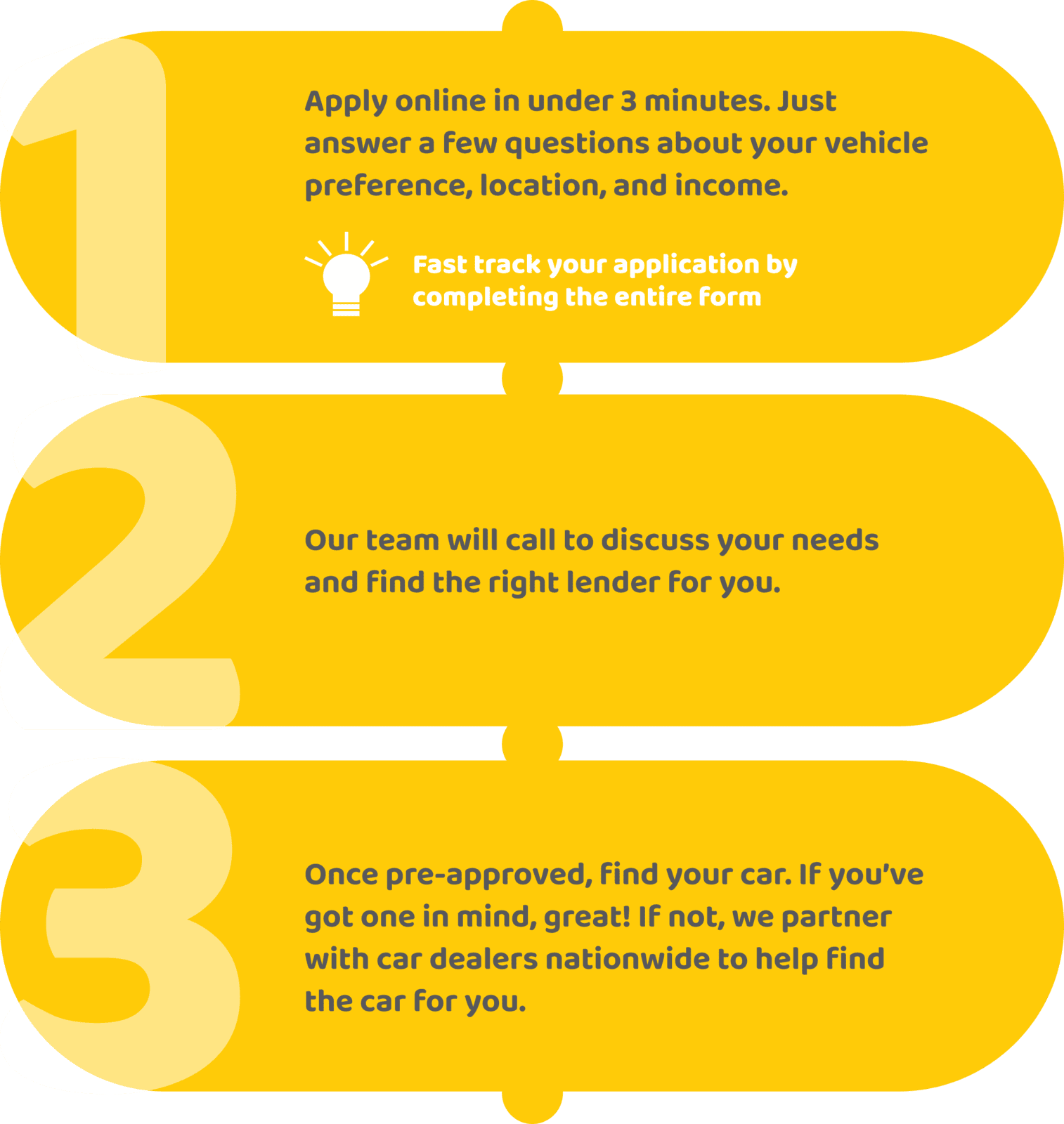

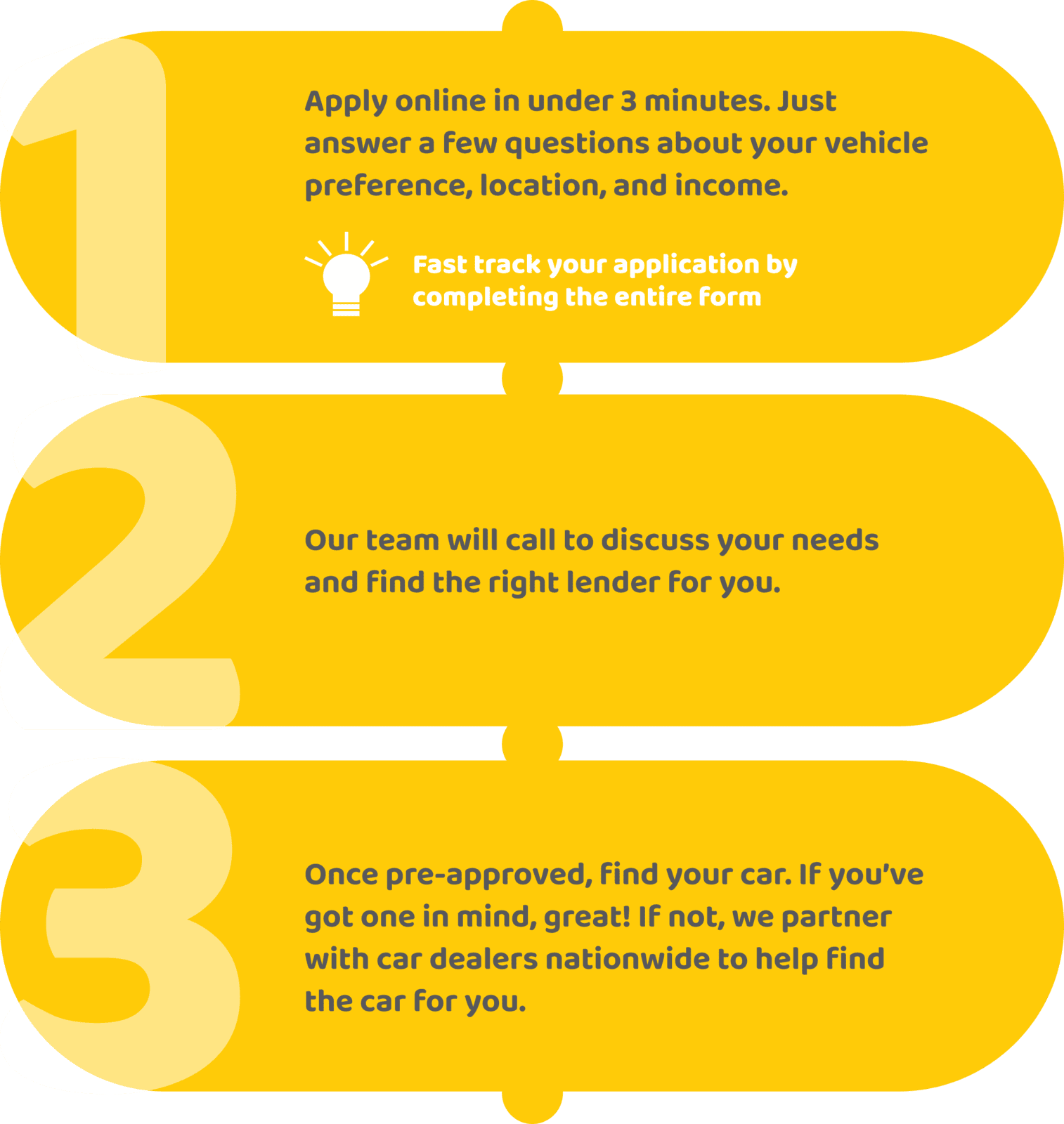

Apply in 3 easy steps

Applying for a loan has never been easier. Our friendly team are ready to assist you in your financial journey.

→ Quick tip; make sure you complete all stages of the application form to fast track your pre-approval.

Apply in 3 easy steps

Applying for a loan has never been easier. Our friendly team are ready to assist you in your financial journey.

→ Quick tip; make sure you complete all stages of the application form to fast track your pre-approval.

Types of Car Loans

When it comes to financing your new or used car, choose a loan type that suits your vehicle and budget.

We compare lenders across Australia and handle the paperwork from quote to settlement.