Refinance your loan

Unhappy with the interest rate on your loan? Let's fix it.

Getting a quote from us is cost and obligation free.

* Subject to suitability, affordability and verification

Refinance your loan

Unhappy with the interest rate on your loan? Let's fix it.

Getting a quote from us is cost and obligation free.

* Subject to verification, affordability & suitability

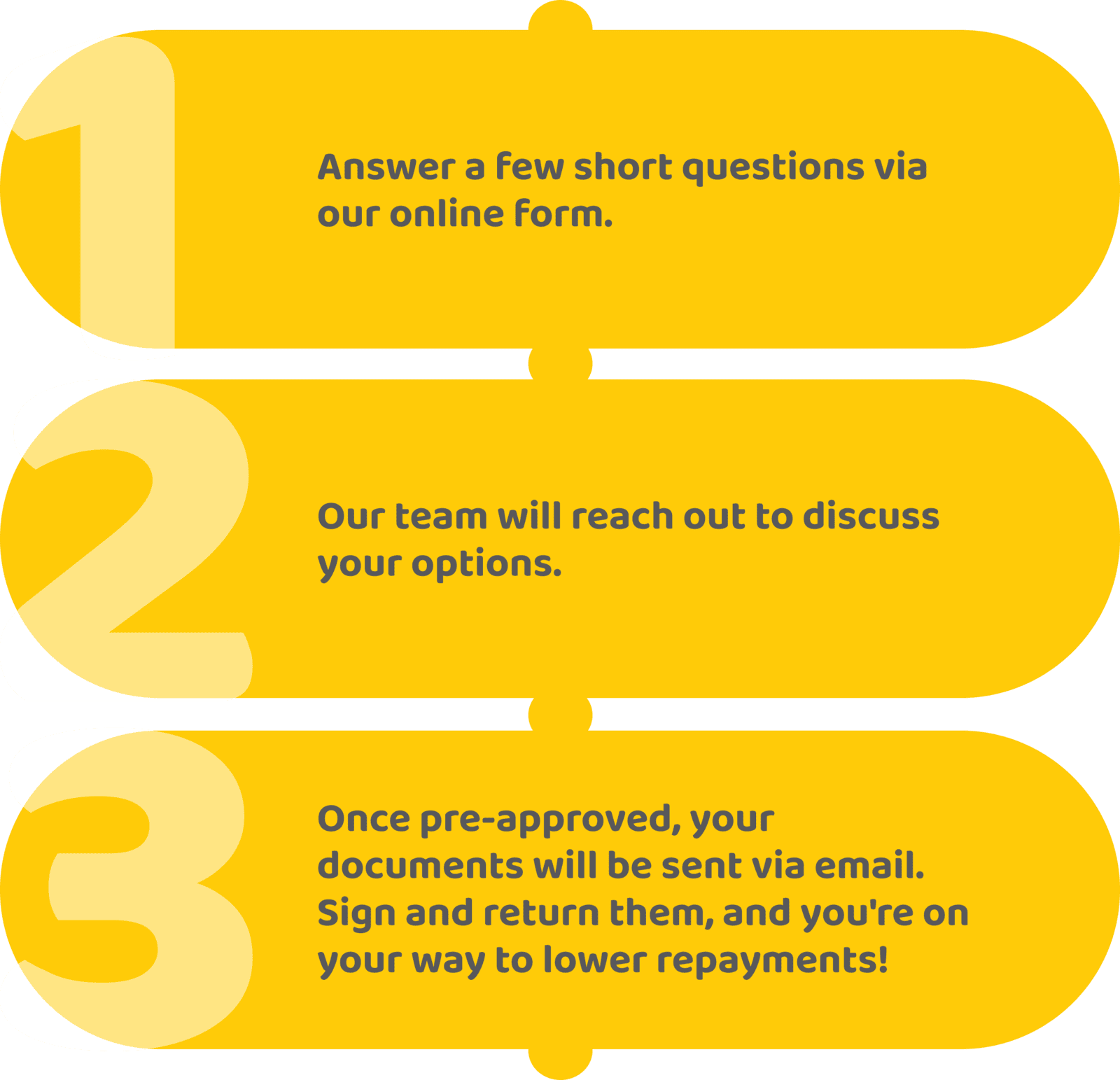

Refinance in 3 easy steps

Refinance in 3 easy steps

Refinancing your loan has never been easier. Our friendly team are ready to assist you in your financial journey.

Refinancing your loan has never been easier. Our friendly team are ready to assist you in your financial journey.

What is refinancing?

Refinancing can improve your finances by potentially lowering monthly repayments or decreasing your interest rate. Our team works hard comparing rates from over 40 lenders to get you the best deal.

At Responsive Lending, our free solution offers financial freedom and savings. Let's explore its benefits!

Lower Interest Rates

Refinancing can mean a lower interest rate, freeing up more cash each month for your financial goals.

Reduce Monthly Repayments

Refinancing allows you to adjust your loan terms, potentially lowering your monthly payments. This can be achieved by securing a lower interest rate or extending the loan term, giving you more financial flexibility to pursue your goals and maintain security.

Enhanced Financial Management

Refinancing not only reduces monthly payments but also allows you to reassess your finances. It's a chance to review goals, budget, and potentially boost savings or investments, encouraging better financial habits for a secure future.

Expert Guidance & Support

Choose Responsive Lending for refinancing. Our expert team ensures a smooth process, evaluating your needs and guiding you to the best plan hassle-free.

No new loan, no charge

No new loan, no charge

Our refinancing service is completely obligation free, and we don't charge you anything unless you are approved for a new lower rate loan!

Once you've applied, all you have to do is wait for a call back. Then, we go away and assess your options for a better rate than you currently have.

Simply click below to get started with a few details and we will begin the search for a better deal!

Our refinancing service is completely obligation free, and we don't charge you anything unless you are approved for a new lower rate loan!

Once you've applied, all you have to do is wait for a call back. Then, we go away and assess your options for a better rate than you currently have.

Simply click below to get started with a few details and we will begin the search for a better deal!